Wednesday, December 31, 2014

Tuesday, December 30, 2014

Monday, December 29, 2014

Saturday, December 27, 2014

Friday, December 26, 2014

Tuesday, December 23, 2014

Ontario home for sale 3 bedroom, 2 baths 1600sqft

For more information call Robert Leidig A real estate

agent with Century21Town&Country CALBRE: 01422758

email robert.leidig@century21.com

web page robertleidighomes.com

|

Monday, December 22, 2014

Home for Sale in Eastvale 4 bedroom, 2 bath 2200 sq,ft

For more information contact Robert Leidig a Real Estate Agent

With Century 21 Town&Country Bre. 01422758 909-957-7661

email robert.leidig@century21.com web page robertleidighomescom

Sunday, December 21, 2014

Home for Sale in Fontana 3 bedroom, 2 baths

For more information contact Robert Leidig

A real estate agent with Century 21 Town &Country

BRE;01422758 909-957-7661 or robert.leidig@century21.com

Web page robertleidighomes.com

Saturday, December 20, 2014

Fontana home for Sale with pool 4 bedroom, 2 baths

For more information contact Robert Leidig a Real Estate agent with Century 21 Town &Country 909-957-7661 or email robert.leidig@century21.com

web page robertleidighomes.com

Friday, December 19, 2014

Beautiful Home in North Fontana with golf coast view in back yard for Sale

For more information Call Robert Leidig A

real estate agent with Century 21 Town &Country

909-957-7661 or email robert.leidig@century21.com

web page robertleidighomes.com

Thursday, December 18, 2014

FORECLOSURE ACTIVITY DECREASES 9 PERCENT IN NOVEMBER

IRVINE, Calif. – Dec. 11, 2014 — RealtyTrac® (www.realtytrac.com), the nation’s leading source for comprehensive housing data, today released its U.S. Foreclosure Market Report™ for November 2014, which shows foreclosure filings — default notices, scheduled auctions andbank repossessions — were reported on 112,498 U.S. properties in November, a decrease of 9 percent from the previous month and down 1 percent from a year ago — the 50th consecutive month with a year-over-year decrease in overall foreclosure activity. The report also shows one in every 1,170 U.S. housing units with a foreclosure filing during the month.

A total of 55,906 U.S. properties started the foreclosure process in November, a decrease of 1 percent from the previous month but a 6 percent increase from a year ago, the first year-over-year increase following 27 consecutive months of year-over-year decreases.

50,102 U.S. properties were scheduled for foreclosure auction during the month, down 16 percent from an 18-month high in the previous month but up 5 percent from a year ago.

Lenders repossessed 25,249 properties in November, down 10 percent from the previous month and down 17 percent from a year ago, making November the 24th consecutive month with year-over-year decreases.

“The housing market is struggling to find the new normal when it comes to a tolerable level of foreclosure activity in this post-Great Recession economy,” said Daren Blomquist, vice president at RealtyTrac. “Finding that ne w normal requires striking a balance between too much loan risk, which would result in another housing meltdown, and too little risk, which could result in a stunted recovery.

w normal requires striking a balance between too much loan risk, which would result in another housing meltdown, and too little risk, which could result in a stunted recovery.

w normal requires striking a balance between too much loan risk, which would result in another housing meltdown, and too little risk, which could result in a stunted recovery.

w normal requires striking a balance between too much loan risk, which would result in another housing meltdown, and too little risk, which could result in a stunted recovery.

“Foreclosure rates on 2014-originated loans are actually higher than 2013-originated loans nationwide and in many markets, indicating that lenders are open to a slightly higher level of risk than we’ve seen over the past five years of extremely tight lending standards,” Blomquist continued. “But it’s unlikely that lenders will dial up that risk level too quickly going forward given that many are still dealing with working through a lengthy and messy foreclosure process on risky loans from the last loose lending spree.”

Scheduled foreclosure auctions increased from a year ago in 30 states, including Kentucky (up 163 percent), Tennessee (up 159 percent), North Carolina (up 157 percent), New Jersey (up 117 percent), Oregon (up 114 percent), New York (up 76 percent), Texas (up 34 percent), Pennsylvania (up 13 percent), Georgia (up 8 percent), and Washington (up 7 percent).

“I think the reason we’ve seen foreclosure activity go up in Seattle over the past year is because banks are simply better prepared for defaults. As a result, they’re able to get a higher volume of foreclosures processed much more quickly,” said OB Jacobi, president ofWindermere Real Estate, covering the Seattle market

Lenders Eased Standards in November

Mortgage availability rose in November, showing signs that the credit box is gradually opening for borrowers, according to the Mortgage Bankers Association's Mortgage Credit Availability Index. The index rose 1.2 percent to 114.6 last month; an increase in the index indicates the loosening of credit.

Still, some banks are adamant that they aren't loosening up. "You won't see us start to expand our credit much past what we've done today," Bank of America CEO Brian T. Moynihan said at a New York investor conference last month. "I don't think there's a big incentive for us to start to try to create more mortgage availability where the consumers are susceptible to default. … I know that doesn't sound good for an instant housing recovery and faster housing markets, but it's actually good because, in the long-term, it keeps housing more fundamentally based."Housing analysts are optimistic that lenders are showing signs of loosening up the tight credit that has sidelined many potential buyers in recent years. Freddie Mac and Fannie Mae's latest move ushers back in loans with 3 percent down payments, which some expect to be a boon for attracting more first-time home buyers to the market.

Wednesday, December 17, 2014

Americans Are 40% Poorer Today

The net worth of American families has plunged 40 percent since 2007, right before the financial crisis struck, dipping to an average of $81,400 per household, according to a new report from the Pew Research Center. That's down from $135,700 in 2007. Pew measures net worth as the difference between the values of a household's assets, including homes, investments, and liabilities.

The average weekly wage has mostly stayed stagnant in recent years: $853 last month compared to $833 in November 2013, according to the Bureau of Labor Statistics."The Great Recession, fueled by the crises in the housing and financial markets, was universally hard on the net worth of American families," the report says.

The drop in net worth is particularly acute along racial lines. The gap between blacks and whites has reached its highest point since 1989, with the wealth of white households 13 times greater than that of black households in 2013, according to Pew research. The median net worth of white households was $141,900 in 2013, dropping 26 percent since 2007; for Hispanic households, net worth in that time fell by 42 percent to $13,700, and for African-American households, it dropped 43 percent to $11,000.

The Pew report partially attributes the wealth gap among the races to the fact that white households are more likely to own stocks directly or indirectly through retirement accounts. Financial assets such as stocks have recovered value more quickly than housing since the recession ended, according to Pew.

However, the housing picture has improved and may help lift many household's finances. Fewer borrowers are underwater, which means they no longer owe more on their mortgage than their home is worth. Eight percent of borrowers, or 4 million, were underwater in October compared to the peak of 35 percent, or 18 million homes, in February 2011, according to data from Black Knight Financial Services, which tracks mortgage performance.

8 Things People Say Their Homes Don't Have

According to the households polled, here's what they don't have that they wish they did:

Energy efficiency: Seventy-one percent of respondents ranked it as important, but only 35 percent are satisfied with their current home's energy efficiency. Utility costs are rising, and Americans' spending on electricity has surged 56 percent since 2000. More home owners are seeking ways to lower their utility costs. Energy-use monitors, smart home thermostats, high-efficiency appliances, and greater smart-home technology may pave the way for change in this area.

Renovation-ready: More than three-quarters of households say their homes require repairs. The recession caused many home owners to delay major projects. The top five major home-improvement jobs identified among households are painting; replacing carpet/flooring; remodeling a bathroom; remodeling a kitchen; and replacing windows and doors.

Updated kitchens and finishes: Many households say their kitchens could use an upgrade. Sixty-two percent of households say an updated kitchen with modern appliances and fixtures is important; only 38 percent are satisfied with their current home's kitchen.

Accessibility: Americans have more needs for accessibility features in their homes that will allow them to age in place. Seventy-six percent of Americans surveyed believe a home they can stay in as they get older is important, but only 53 percent think their home meets that criteria. Baby boomers are increasingly interested in single-story homes, but they aren't necessarily interested in slimming down the home's square footage, Burbank notes.

Affordability: One in five Americans surveyed say they are unsatisfied with the cost of their current living situation. Twenty-six percent of owners and 40 percent of renters are spending more than 30 percent of their income on housing expenses. Eighty-one percent say it's important that their housing costs fit their budget without requiring sacrifices. However, 60 percent say they've achieved this, while the rest say they do have to make sacrifices to afford their home. "There's certainly a well-documented shortage of affordable housing, particularly when it comes to renters, and the situation is only getting worse," says Burbank.

Safety: Twenty-two percent of those surveyed say they're unsatisfied with the safety in their current home. About one-fifth of that group — most of whom live in non-urban areas — say they feel their neighborhood has become less safe in recent years. Home security systems and other technology may be the key to providing home owners with more peace of mind, Burbank says.

Privacy: More households desire privacy from their neighbors. Sixty-three percent consider privacy important, but only 42 percent say they're satisfied with their current home's privacy.

Greater storage: Nearly half of people planning to move say they want more space than they have in their current home. A home with ample storage space is an important feature households identified, and it's one of the key reasons they want to renovate, too. Fifty-five percent of households say a home with storage space is important, but only 35 percent are currently satisfied with their home's storage space.

Tuesday, December 16, 2014

Monday, December 15, 2014

Friday, December 12, 2014

70% Unaware of Down-Payment Assistance

Seventy percent of adults in the U.S. say they're unfamiliar with down-payment assistance programs for middle-income home buyers in their community, according to a NeighborWorks America surveyof 1,000 people. But plenty of help is available.

NeighborWorks organizations provided 6,000 buyers with more than $100 million in down-payment assistance last year. NeighborWorks expects to increase its assistance this year, too. Many local and state organizations offer down-payment assistance as well, and there are specialized programs for military vets through the Veterans Affairs loan program, for first-time buyers through the Federal Housing Administration, and for rural home buyers through the U.S. Department of Agriculture.

"Down-payment assistance programs make home purchasing more accessible for first-time buyers," says Marietta Rodriguez, vice president of Homeownership Programs and Lending at NeighborWorks America. "In addition, because many down-payment assistance programs require home-buyer education, these purchasers tend to be more successful in the long-term. Research has shown pre-purchase counseling helps reduce mortgage default and equips home owners with the information they need to budget for other expenses and maintain their property."

Thursday, December 11, 2014

2015: Year of the First-Time Home Buyer

First-time home buyers are expected to re-emerge in the new year after mostly staying out of the market in the aftermath of the housing crisis. That's one of realtor.com®'s five top housing predictions for 2015.

"The residual financial effects of recession-driven job losses and subsequent unemployment have impeded Millennials' entry into the home-owning market," says Jonathan Smoke, chief economist for realtor.com®. "In 2015, increases in employment opportunities will empower younger buyers to return to the market and fuel the continued housing recovery. If access to credit improves, we could see substantially larger numbers of young buyers in the market. However, given a high dependency on financial qualifications, this activity will be skewed to geographic areas with higher affordability, such as the Midwest and South."

"The residual financial effects of recession-driven job losses and subsequent unemployment have impeded Millennials' entry into the home-owning market," says Jonathan Smoke, chief economist for realtor.com®. "In 2015, increases in employment opportunities will empower younger buyers to return to the market and fuel the continued housing recovery. If access to credit improves, we could see substantially larger numbers of young buyers in the market. However, given a high dependency on financial qualifications, this activity will be skewed to geographic areas with higher affordability, such as the Midwest and South."

- Millennials to drive household formation. Households headed by Millennials are expected to see significant growth in 2015, particularly as the economy continues to make gains. Millennials are expected to drive two-thirds of household formations over the next five years, according to realtor.com®'s report. The forecasted addition of 2.5 million jobs next year, as well as an increase in household formation, are the two factors that realtor.com® points to in driving more first-time home buyers to the housing market.

- Existing-home sales on the rise. Existing-home sales are projected to rise 8 percent year-over-year in 2015, as more buyers enter the market. Distressed properties will make up a smaller share of that growth, unlike in 2012, when a similar increase in existing-home sales was mostly driven by distressed properties.

- Home prices will rise. Home prices are expected to continue to edge up in 2015, with realtor.com® forecasters predicting a 4.5 percent gain. "While first-time home buyers have many economic factors working in their favor, increasing home prices will make it more difficult to get into high-priced markets such as San Francisco and San Jose, Calif.," realtor.com® notes in its report. "As a result, first-time home buyer activity is expected to concentrate in markets with strong employment and affordability, such as Des Moines, Iowa; Atlanta; and Houston."

- Mortgage rates to inch up to 5 percent. In the middle of 2015, mortgage rates are expected to increase as the Federal Reserve increases its target rate by at least 50 basis points before the end of the year. That will likely bring the 30-year fixed-rate mortgage to an average of 5 percent by the end of 2015. (It's currently averaging 3.89 percent, according to Freddie Mac.) The 1-year adjustable-rate mortgage, on the other hand, is expected to rise more minimally. "Lower ARM interest rates will influence an uptick in buyer interest for adjustable and hybrid mortgages," realtor.com® notes. "While still at historic lows, rate increases will affect housing affordability for first-timers trying to break into the housing market and will be another factor pushing them to less-expensive locales."

- Housing affordability will decline. Affordability for homes, based on home-price appreciation and rising mortgage interest rates, will likely fall by 5 to 10 percent in 2015. However, the decline in affordability likely will be offset by an increase in salaries next year for many households. "When considering historical norms, housing affordability will continue to remain strong next year," realtor.com® notes.

10 Markets to Grow the Most Next Year

The U.S. housing market is expected to make strides overall in 2015, but 10 metros in particular are "ready for significant acceleration across housing metrics" next year, according to realtor.com®'s latest housing report

"The markets on this list range from big cities with older housing stock, big and mid-size cities with substantial levels of new construction, and up-and-coming markets appealing to young professionals for their job growth and high affordability," says Jonathan Smoke, realtor.com®'s chief economist.

Los Angeles and Washington, D.C., for example, made the list because of expected increases in household formation and home sales there in 2015, realtor.com® notes. On the other hand, Des Moines, Iowa, made the list because of its high affordability and high levels of home ownership among Millennials, which are expected to continue next year.

Realtor.com®'s top 10 markets for growth in 2015 (as well as what local metric to watch the most next year) are:

- Atlanta-Sandy Springs, Ga.: Household formation growth; home sales expected to rise 11%.

- Dallas-Fort Worth-Arlington, Texas: Household formation (ranks first in forecasted household growth over the next 5 years); home sales expected to rise 7%.

- Denver-Aurora-Broomfield, Colo.: Home-sale growth projected to be 14%; tight inventories of for-sale homes.

- Des Moines-West Des Moines, Iowa: Growth in Millennial share of households.

- Houston-The Woodlands, Texas: Household formation growth; employment to grow by 4%; home sales to increase by 5%.

- Los Angeles-Long Beach, Calif.: Household formation growth; home sales to grow by 6%.

- Minneapolis-St. Paul-Bloomington, Minn.: Millennial home owner growth; increase in new-home construction.

- Phoenix-Mesa-Glendale, Ariz.: Income growth; increase in new-home construction by 22%; home sales expected to grow by 11%.

- San Jose-Sunnyvale-Santa Clara, Calif.: Tight inventories of homes for sale; income growth; home prices and home sales both expected to grow by 3%.

- Washington, D.C.: Household formation growth; tight inventories of homes for sale; home sales expected to rise 10%.

Wednesday, December 10, 2014

3% Down Payments May Be Game Changer

Freddie Mac launched Home Possible Advantage, a conventional mortgage with a 3 percent down-payment requirement geared to low- and moderate-income borrowers. It's a conforming conventional mortgage with a maximum loan-to-value ratio of 97 percent. To qualify, first-time home buyers are required to participate in a borrower education program.

With Fannie Mae's 3 percent down-payment offering, borrowers must still meet standard eligibility requirements, including underwriting, income documentation, and risk management standards. Any buyer can take advantage of Fannie's loans as long as at least one co-borrower is a first-time buyer. The loans will require private mortgage insurance

NAR said in a statement that the action by FHFA demonstrates its "commitment to home ownership by serving creditworthy borrowers who lack the resources for substantial down payments, plus closing costs, with a new 3 percent down-payment program that mitigates risk with strong underwriting. The new program ensures that responsible home buyers will have access to safe, affordable mortgage credit."

Buyers' and Sellers' Confidence Diverges

The gap between those who say it's a good time to buy a home and those who say it's a good time to sell is growing larger. Sixty-eight percent of Americans say now is the time to buy, a month-over-month rise of 3 percentage points, according to Fannie Mae's November 2014 National Housing Survey of 1,000 respondents. On the other hand, the number of Americans who say it's a good time to sell fell 5 percentage points to 39 percent.

One of the most encouraging signs for the housing market's future: Consumers' personal financial outlook is improving. Forty-six percent of Americans say they expect their personal financial situation to improve over the next 12 months. That's close to the survey's all-time high.

Also, among the survey's findings:

One of the most encouraging signs for the housing market's future: Consumers' personal financial outlook is improving. Forty-six percent of Americans say they expect their personal financial situation to improve over the next 12 months. That's close to the survey's all-time high.

Also, among the survey's findings:

- 45 percent of respondents say they believe mortgage rates will rise in the next 12 months (a drop of 3 percentage points from the previous month);

- 53 percent say they expect rental prices to rise in the next 12 months (a rise of 4 percentage points from last month);

- 62 percent say they would buy a home if they were going to move, while the share who say they'd rent rose to 31 percent;

- 25 percent say their household income is significantly higher than it was 12 months ago (the same as last month);

- 36 percent say their household expenses are significantly higher than they were 12 months ago (the same as last month).

Tuesday, December 9, 2014

First-Time Buyers' Myths About Mortgages

Realtor.com® predicts 2015 will be the year of the first-time home buyer — because job growth next year should drive Millennials back into the housing market . Many of them have some misguided ideas about mortgages. First-time buyers often mistakenly believe these myths about mortgage lending:

- Lending requirements are still too tight. (Actually, mortgage standards have been easing dramatically.)

- It's not necessary to check your credit before embarking on the mortgage process.

- "Preapproved" and "prequalified" are interchangeable terms.

- You should wait until after choosing a home before talking to a lender.

- You must have a 20 percent down payment.

- You should focus your home search solely on your wants.

- You do not need a home inspection.

Monday, December 8, 2014

Market Update for Eastvale the last 7 days

Thinking about Buying or Selling in Eastvale? Give me a call

Robert Leidig a Real Estate Agent with Century 21 Town&Country

Bre; 01422758 909-957-7661 or email robert.leidig@century21.com

web page robertleidighome.com

Market Update for the City of Claremont California

Thinking about Buying or Selling in Claremont ? Give me a call

Robert Leidig a Real Estate Agent with Century 21 Town&Country

Bre; 01422758 909-957-7661 or email robert.leidig@century21.com

web page robertleidighome.com

Market Update for Fontana the last 7 days

Thinking about Buying or Selling in Fontana? Give me a call

Robert Leidig a Real Estate Agent with Century 21 Town&Country

Bre; 01422758 909-957-7661 or email robert.leidig@century21.com

web page robertleidighome.com

Market Update for Ontario California in the last 7 days

Thinking about Buying or Selling in Ontario? Give me a call

Robert Leidig a Real Estate Agent with Century 21 Town&Country

Bre; 01422758 909-957-7661 or email robert.leidig@century21.com

Market Update fro Rancho Cucamonga for the last 7 days

| New Listing (30) | |

| Price Change (30) | |

| Back On Market (21) | |

| Backup Offer (24) | |

| Expired (13) | |

| Pending (30) | |

| Sold (41) |

Thinking about Buying or Selling in Rancho Cucamonga?

Contackt me Robert Leidig 909-957-7661 or email

robert.leidig@century21.com

HAMP Borrowers Can Earn Extra $5K Reward

The government is throwing in more incentives to keep borrowers who modify their loans through the Home Affordable Modification Program current on their mortgages. HAMP borrowers who pay on time can earn an extra $5,000 in their sixth year of payments. That's on top of the $5,000 borrowers are already eligible for if they make on-time payments through the first five years of their loans, the Treasury Department and Department of Housing and Urban Development announced this week.

Borrowers stand to get $10,000 in incentives for on-time payments, which all goes toward reducing their principal balance. HAMP will then give borrowers the option to re-amortize the reduced balance in order to lower their overall monthly payments, the Treasury Department said.

An estimated 1 million home owners with HAMP loans will likely be eligible for the additional $5,000 incentive.

The extra incentive comes at a time when about 30,000 HAMP loans are to reset this year. When the loans begin to reset, the interest rate will rise by one percentage point per year until it reaches the agreed upon rate when the modification was created. Reset rates will range from 4 percent to 5.4 percent.

Also this week, the Treasury Department announced that distressed home owners who complete a short sale or deed-in-lieu will now be offered $10,000 in relocation assistance, a $7,000 increase over what they previously received. And there's an extra incentive for borrowers in the HAMP Tier 2 alternative program, which provides a low fixed interest rate for borrowers who were unable to qualify for a standard HAMP modification. HAMP Tier 2 alternative borrowers now are able to pay a 50-basis point lower interest rate and earn the $5,000 incentive if they make on-time payments by the end of their sixth year.

"While the housing sector has strengthened in recent years, there are still many homeowners struggling to make their mortgage payments," says Treasury Secretary Jacob Lew. "The changes we are announcing today offer meaningful incentives for borrowers to stay current in their modifications, increase their opportunity to build equity in their homes, and provide vital safety nets for those facing greater financial strains."

Source: U.S. Department of Housing and Urban Development and “Treasury to Offer Rewards for Current HAMP Borrowers,” National Mortgage News (Dec. 4, 2014)

Friday, December 5, 2014

Housing affordability in California holds steady in third quarter but improves in Bay Area

LOS ANGELES (Nov. 7) – Lower interest rates and minimal home price gains kept California’s housing affordability in check in the third quarter of 2014 and even helped improve affordability in some high-cost counties in the San Francisco Bay region, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.

The percentage of home buyers who could afford to purchase a median-priced, existing single-family home in California in third-quarter 2014 was unchanged from the 30 percent recorded in the second quarter of 2014 but was down from a revised 32 percent in third-quarter 2013, according to C.A.R.’s Traditional Housing Affordability Index (HAI). This is the sixth consecutive quarter that the index was below 40 percent.

Home buyers needed to earn a minimum annual income of $94,960 to qualify for the purchase of a $467,700 statewide median-priced, existing single-family home in the third quarter of 2014. The monthly payment, including taxes and insurance on a 30-year, fixed-rate loan, would be $2,370, assuming a 20 percent down payment and an effective composite interest rate of 4.23 percent. The effective composite interest rate in second-quarter 2014 was 4.32 percent and 4.36 percent in the third quarter of 2013.

The percentage of home buyers who could afford to purchase a median-priced, existing single-family home in California in third-quarter 2014 was unchanged from the 30 percent recorded in the second quarter of 2014 but was down from a revised 32 percent in third-quarter 2013, according to C.A.R.’s Traditional Housing Affordability Index (HAI). This is the sixth consecutive quarter that the index was below 40 percent.

Home buyers needed to earn a minimum annual income of $94,960 to qualify for the purchase of a $467,700 statewide median-priced, existing single-family home in the third quarter of 2014. The monthly payment, including taxes and insurance on a 30-year, fixed-rate loan, would be $2,370, assuming a 20 percent down payment and an effective composite interest rate of 4.23 percent. The effective composite interest rate in second-quarter 2014 was 4.32 percent and 4.36 percent in the third quarter of 2013.

Thursday, December 4, 2014

Share of First Time Buyers Fells to lowest point in three years

Despite an improving job market and low interest rates, the share of first-time buyers fell to its lowest point in nearly three decades, according to an annual survey released today by the National Association of REALTORS®.

NAR's Profile of Home Buyers and Sellers dates back to 1981. The average rate of first-time buyers during that time has been around four out of 10 purchases. In this year’s survey, the share of first-time buyers dropped 5 percentage points from a year ago to 33 percent, representing the lowest share since 1987 (30 percent).

Rising rents and repaying student loan debt makes saving for a down payment more difficult, especially for young adults who’s experienced limited job prospects and flat wage growth since entering the workforce.

When asked about the primary reason for purchasing, 53 percent of first-time buyers cited a desire to own a home of their own. Most in this group say they plan to stay in their home for 10 years and they are 10 percent more likely to purchase a townhouse or a condo than repeat buyers. The median age of first-time buyers was 31, unchanged from the last two years, and the median income was $68,300 (up from $67,400 in 2013). The household composition of all buyers responding to the survey was mostly unchanged from a year ago; 65 percent were married couples, 16 percent single women, 9 percent single men, and 8 percent unmarried couples. Thirteen percent of survey respondents were multi-generational households, including adult children, parents and/or grandparents.

The typical first-time buyer purchased a 1,570 square-foot home costing $169,000. The survey also found that 47 percent of first-time buyers said the mortgage application and approval process was much more or somewhat more difficult than expected (an increase of four percent over last year). Among 23 percent of first-time buyers who said saving for a downpayment was difficult, more than half (57 percent) said student loans delayed saving, up from 54 percent a year ago.

Wednesday, December 3, 2014

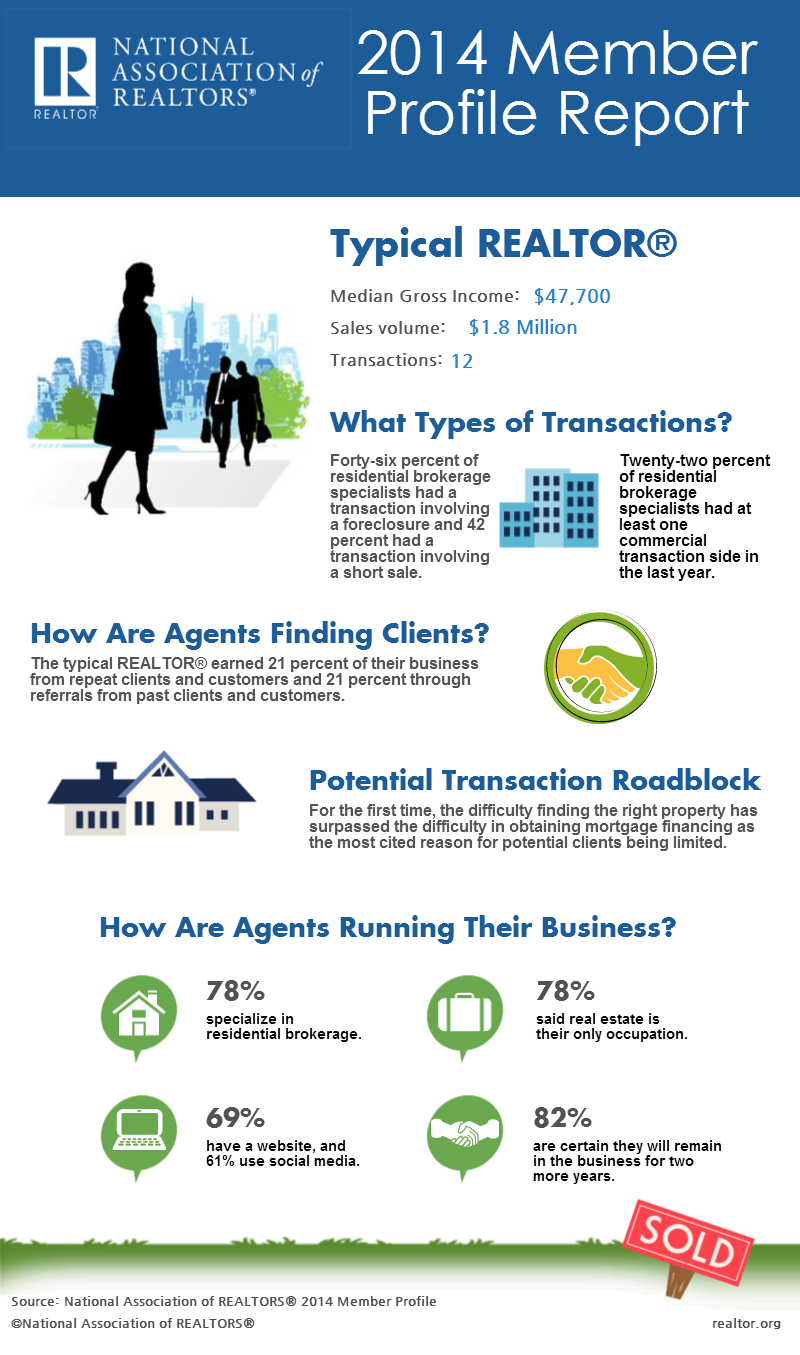

60% of REALTORS® Make the Deals

Forty percent of Realtors did not close a single transaction in the first six months of this year, according to a newly released REALTOR® Productivity Study of Multiple Listing Service activity conducted by the WAV Group and sponsored by the REALTORS Property Resource®. The survey reflects responses from nearly 335,000 REALTORS®. it looks like a new 60 percent rule is the true standard for real estate.”

The study also found that REALTORS® tend to be optimistic about the direction of their local housing markets, despite continued inventory challenges. Twenty-nine percent of REALTORS® surveyed say they are “very optimistic” about their local markets while 71 percent say they are “cautiously optimistic.” Their optimism comes at a time when low housing inventory problems persist. More than 80 percent of the REALTORS® surveyed categorized their local inventory as “somewhat” or “very” limited.

The study also found that REALTORS® tend to be optimistic about the direction of their local housing markets, despite continued inventory challenges. Twenty-nine percent of REALTORS® surveyed say they are “very optimistic” about their local markets while 71 percent say they are “cautiously optimistic.” Their optimism comes at a time when low housing inventory problems persist. More than 80 percent of the REALTORS® surveyed categorized their local inventory as “somewhat” or “very” limited.

Tuesday, December 2, 2014

Loan Limits Raised in Four California Countires

| LOAN LIMITS RAISED IN FOUR CALIFORNIA COUNTIES BY FANNIE, FREDDIE Source: LA Times As a result of rising home prices, Fannie Mae and Freddie Mac have announced adjustments on the upper limits of loans for four counties in the state of California. The adjustments include: Napa at $615,250, up from $592,250; Ventura at $603,750, up from $598,000; San Diego at $562,350, up from $546,250; and Monterey at $502,550, up from $483,000. Also, 42 other counties across the nation will see their upper limits increased. |

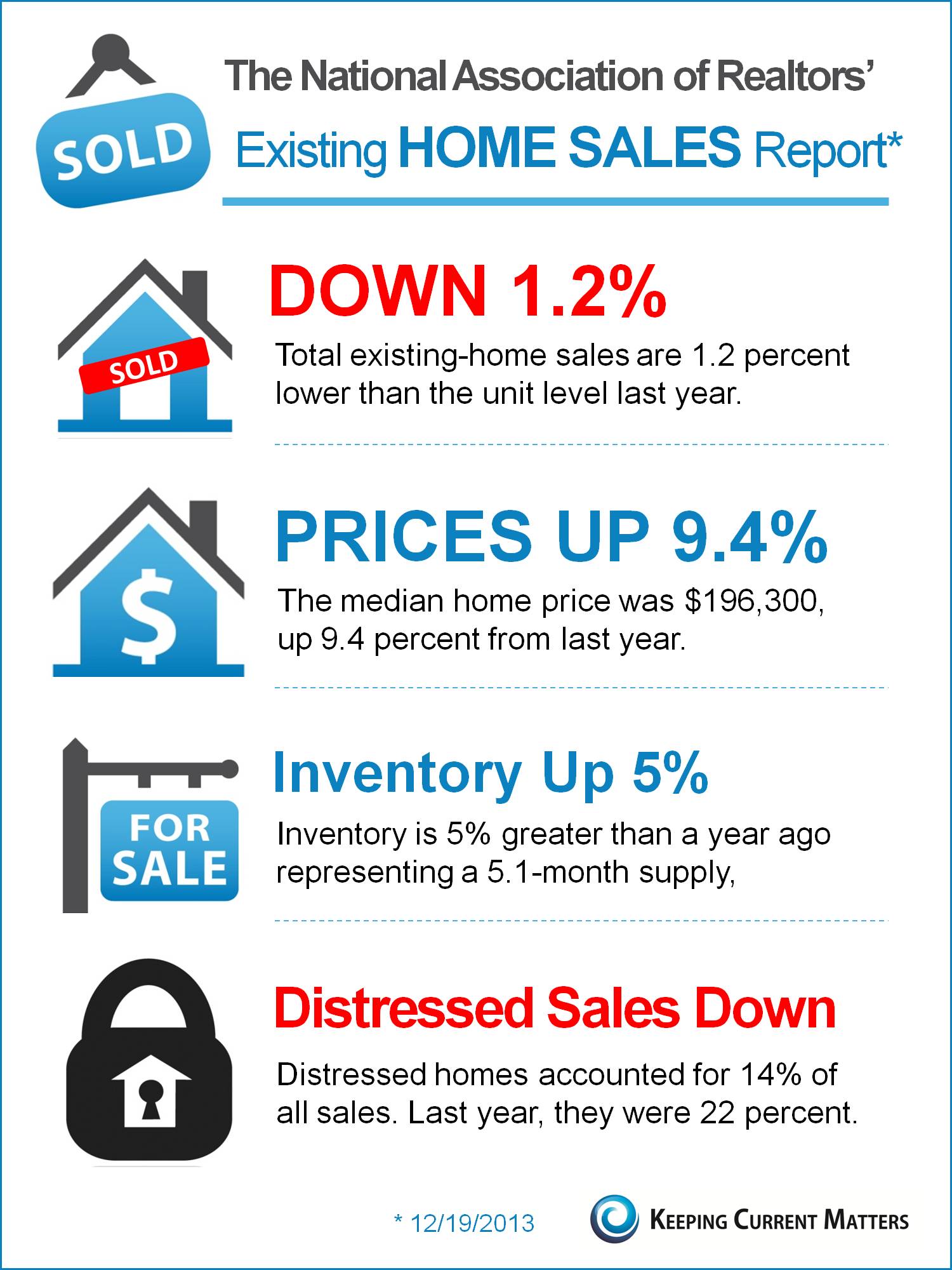

Housing Sales inventory continues to Grow

Housing sales inventory continues to grow in October

Lower-priced home inventory lags; high-end homes picking up

The number of homes for sale continued to increase across the U.S. in October, a good sign for buyers, but mainly for those on the higher end, according to the latest data from Zillow (Z) Real Estate Markets report for October.

In many parts of the country, supply increased more among the most expensive homes than low- and mid-priced homes

The inventory of for-sale homes in the bottom home-price tier rose year-over-year in 68.3% of the 353 total metro areas analyzed by Zillow, while inventory in the top home price tier rose in 82.2%, or 290 of the 353 markets analyzed. Inventory of all homes for sale nationwide increased by 15.8% year-over-year.

“Depending on their finances, it’s likely that individual buyers in the same market might be having completely different home buying experiences. Even as conditions improve for buyers overall, it remains a tough row to hoe for first-time buyers and lower-income buyers, especially compared to their more well-off contemporaries,” said Zillow Chief Economist Stan Humphries. “We expect more demand to come from the lower end of the market in coming years as millennials overtake Generation X as the largest home-buying demographic. As this happens, builders will be forced to build for these more entry-level buyers, and inventory at the bottom tier should improve, however slowly.”

In Denver, there were almost four times as many homes available for sale in the upper price tier (priced at $357,900 or more) than there were homes priced in the lowest price tier (less than $219,000).

The same was true in many other markets. Dallas, Atlanta, Phoenix and Nashville had at least two times more homes for sale in the top tier than the bottom tier.

In 25 of the 35 largest metros analyzed, there were more homes for sale this October than last October in all three price tiers. In 14 of those metros, the increase in number of homes for sale was in the double digits in all price tiers.

Overall, median U.S. home values rose 6.4% from October 2013 and 0.4% from September, to a Zillow Home Value Index of $177,500.

Both monthly and annual home value gains were well below the faster paces recorded earlier in the year. Rising inventory and slowing home-value growth are two signs that the housing market is beginning to level off across the nation.

As the market has cooled, buyers looking for less expensive homes did find some relief in the hottest metro areas, including San Diego, Los Angeles and the Bay Area. In San Francisco, the number of low-priced homes on the market rose by 39%, but there were fewer high-priced homes on the market. While inventory was still tight there in October, the homes that were available spread evenly across the price spectrum.

Subscribe to:

Posts (Atom)